Article from the website of MSN:

"Cyrus Mistry is right; problems of the Tata Group were inherited, not of his making"

Some snippets:

Almost every newspaper article which has anything to say about Tata Sons and the upheaval this company witnessed at a board meeting on Monday, lays the blame at Cyrus Mistry's door. Not many commentators have found fault with Mistry's predecessor Ratan Tata, nor have they bothered to analyse how Mistry was given a troubled empire and was left to deal with the mess, with his hands tied.

According to most analysts, nothing that Mistry did in his short four-year tenure was right. He allegedly did not uphold the values that the Tatas have stood for, he moved slowly on the group's restructuring and worst of all he sold family jewels like the steel business in UK - these are some of the myriad allegations which have surfaced in the last 48 hours, after Mistry was sacked as Tata Sons' Chairman.

But was Mistry the sole reason behind the Tata group's sub-optimal workings - the group's debt was rising, profitability was suffering and was he squarely to be blamed for the NTT DoCoMo fiasco or the crisis at the group's steel unit in the UK? According to this piece in the Economic Times, Mistry has denied most of these allegations in a mail to Tata Sons after the momentous Monday meeting. He has also leveled serious charges against members of the board, besides rightfully pointing out the harm to the group's credibility from this sudden sacking.

As several industry watchers wonder about corporate governance practices and whether these were followed while the board sacked Mistry, it is pertinent to note that Mistry could be right on all counts actually. He is surely not to blamed, at least not entirely, for what went wrong in the Tata group's telecom business, in the group's miscalculations of forming two competing ventures in the field of aviation, in the foreign acquisition spree pre-dating Mistry's chairmanship which led to the group's debt pile expanding.

The interesting part for Malaysia and Singapore involves the airline business:

In the email, Mistry said that the group's foray into aviation through joint ventures with Air Asia BhD and Singapore Airlines was at the behest of Tata. In both cases he had been presented with a fait accompli. He is right on both counts. It was Ratan Tata's long standing dream to enter civil aviation business - something which he had tried to do unsuccessfully twice in the past and was finally able to accomplish with AirAsia BhD when the government eased rules for foreign airlines to pick up a stake in Indian carriers. The joint venture company was formed in 2013, surprisingly, as a three way arrangement where the Tatas picked up only 30 percent and a lesser known Indian company Telestra Tradeplace held 21 percent.

The brand image of Tatas was in complete contrast with the ultra low-cost offering of AirAsia India. Even as the JV was continuously plagued with allegations about undue influence of the Malaysian parent - Telestra, which was finally bought out by the Tatas earlier this year after a messy battle splashed all over the newspapers, the airline's expansion plans also suffered due to bickering among the shareholders. And while this low-cost venture was struggling, the Tatas went ahead and forged another venture, with Singapore Airlines, to form full-service carrier Vistara in January 2015. Again at Ratan Tata's behest. The two airlines now operate at the fringes of India's domestic aviation market in terms of market share.

Mistry probably did not bless the creation of two separate, competing companies in the same business - a business where margins are wafer thin and profitability remains a pipe dream - so it would be foolish to lay the blame at his door. No one has understood till date why two airline ventures were formed or why Tatas initially chose to be 'silent' partners in AirAsia India.

I have in my possession a PDF-file which might be the alleged email from Cyrus Mistry, the header of the email reads as follows:

I do not know if this document is authentic, some parts have been blacked out, others have been truncated.

The first paragraph:

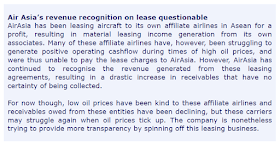

The parts about Singapore Airlines and Air Asia:

One crore is equal to 10,000,000 Rupees (or 10,00,000 as they write in India), worth about RM 623,000 or SGD 208,000.

It will be interesting to see how this will pan out, the fight between Tata and Cyrus Mistry, and if the above email is indeed authentic.