Utusan Melayu (Malaysia) announced that it is selling its stake in Maqamad Sdn Bhd for RM 48 Million. It had bought this stake eight months before for only RM 100K.

Kinibiz's "Tigertalk" wrote about the deal:

"What about the possibility that Utusan has been harbouring the Malaysian answer to Warren Buffett all this while? Possible, possible… the possibilities are endless. Numbers don’t lie and Utusan really is selling what it says was worth RM100,000 eight months ago for RM48 million now.

With an investment manager able to pick out an investment giving 47,900% in returns within an eight-month timeframe lurking in our midst, perhaps Khazanah Nasional extended the contract of its managing director Azman Mokhtar a tad too hastily, eh?"

Details are scant, understandably so, why would any fund manager give away his secrets? Transparency is of course for softies, while corporate governance, honestly, who cares with RM 48 Million cash in the bank?

Warren Buffett's record on Berkshire Hathaway is definitely not bad, increasing the share price from USD 13 to about USD 200,000. But that took a full fifty years, who has so much patience?

Buffett's track record shows an annualized return of about 21% per year, while Utusan scored 47,900% in only eight months time. Now we are talking business ......

Wishing all readers happy holidays.

A Blog about [1] Corporate Governance issues in Malaysia and [2] Global Investment Ideas

Thursday, 24 December 2015

Asian fund managers (4)

BFM interview with James Hay from the Pangolin Fund.

Some of the subjects:

Some of the subjects:

- Nestle

- Public Bank

- Malaysia shunned at the moment, might indicate opportunity

- Hup Seng

- Padini

- Dairy Farm

- Excellent corporate governance

- Avoiding GLCs like Maybank, would these companies be able to compete outside Malaysia?

- Stressing importance of research, also on the ground

Wednesday, 16 December 2015

Maybulk: large paperlosses on its investment in POSH (4)

I wrote before:

- POSH should write down its intangibles, which will decrease its book value

- Maybulk should impair it's investment in POSH, it should have marked to market it's investment.

There are some indications that the above might (finally) happen, at least to some degree.

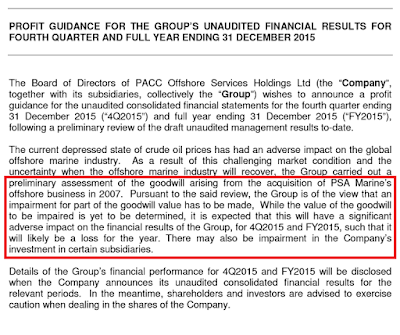

From POSH's latest announcement:

From Maybulk's latest quarterly announcement:

That will not give any consolation to current shareholders in any of these two companies, especially since the normal operations of both companies will be rather bad, due to the current economic environment in both the shipping and oil & gas industry. For the shareholders it will be a case of "when it rains, it pours".

But after the impairments the balance sheet of both companies will give at least a somewhat more realistic picture, something that was overdue for quite some time.

Tuesday, 15 December 2015

1MDB needs a new script (3)

I wrote before about Avestra Asset Management and its curious relationship with 1MDB (here and here).

The Australian published today an article "Court shuts Avestra schemes linked to 1MDB crisis" on its website that seems relevant.

The Federal Court has ordered the shutdown of five investment schemes run by Avestra Asset Management, a Gold Coast financial services group drawn into Malaysia’s 1MDB crisis.

Judge Jonathan Beach made the orders after reading a report from provisional liquidators that found undisclosed related-party transactions, 13 potential breaches of corporate law and failure to invest according to the fund’s individual mandates.

The report, compiled by Simon Wallace-Smith and Richard Hughes of Deloitte and released to The Australian by the court, also reveals that a Cayman Islands vehicle linked to the 1MDB scandal is the owner of the Avestra Credit Fund, which backed a takeover bid against Malaysian company Harvest Court Industries.

The Australian published today an article "Court shuts Avestra schemes linked to 1MDB crisis" on its website that seems relevant.

The Federal Court has ordered the shutdown of five investment schemes run by Avestra Asset Management, a Gold Coast financial services group drawn into Malaysia’s 1MDB crisis.

Judge Jonathan Beach made the orders after reading a report from provisional liquidators that found undisclosed related-party transactions, 13 potential breaches of corporate law and failure to invest according to the fund’s individual mandates.

The report, compiled by Simon Wallace-Smith and Richard Hughes of Deloitte and released to The Australian by the court, also reveals that a Cayman Islands vehicle linked to the 1MDB scandal is the owner of the Avestra Credit Fund, which backed a takeover bid against Malaysian company Harvest Court Industries.

Subscribe to:

Posts (Atom)