Sam Ro | Aug. 1, 2012

Goldman Sachs considers Korean trade data to be Asia's "canary in the coal mine" due to its high correlation to economic activity in mainland Asia.

Unfortunately, the canary is looking sick.

South Korean July exports plunged 8.8 percent from a year ago. Economists surveyed by Bloomberg were looking for a decline of 3.7 percent.

This disappointing number comes as global PMI data shows that deterioration in the world's manufacturing sectors.

Jim O'Neill, Chairman of Goldman Sachs Asset Management has previously argued that PMI and South Korean trade data were among the most reliable economic indicators in the world.

So, there's not much good news coming from the Asian economies. At this point, it seems the data is increasingly justifying further easy monetary policy measures from local central banks.

Marc Faber warned about commodity prices looking weak, here is the 10 year Dow Jones UBS Commodity Index:

- A huge bubble developed between 2002 and 2008 (partly caused due to the irresponsible money printing)

- The severe global recession in 2008/2009

- The recovery in 2010/2011

- The clear recent weakness in the last year, 20% down from the top in April 2011. Not exactly what one would expect in a strong economy.

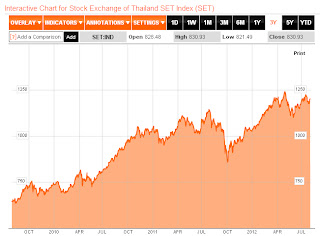

On a personal note, I have sold a decent part of my equity holdings, one example was a Thai Fund I bought in 2010 on a general recommendation of Marc Faber (I am a very happy subscriber of his Gloom, Boom & Doom newsletter), this is the Thai index over the last 3 years:

No comments:

Post a Comment