Utusan Melayu (Malaysia) announced that it is selling its stake in Maqamad Sdn Bhd for RM 48 Million. It had bought this stake eight months before for only RM 100K.

Kinibiz's "Tigertalk" wrote about the deal:

"What about the possibility that Utusan has been harbouring the Malaysian answer to Warren Buffett all this while? Possible, possible… the possibilities are endless. Numbers don’t lie and Utusan really is selling what it says was worth RM100,000 eight months ago for RM48 million now.

With an investment manager able to pick out an investment giving 47,900% in returns within an eight-month timeframe lurking in our midst, perhaps Khazanah Nasional extended the contract of its managing director Azman Mokhtar a tad too hastily, eh?"

Details are scant, understandably so, why would any fund manager give away his secrets? Transparency is of course for softies, while corporate governance, honestly, who cares with RM 48 Million cash in the bank?

Warren Buffett's record on Berkshire Hathaway is definitely not bad, increasing the share price from USD 13 to about USD 200,000. But that took a full fifty years, who has so much patience?

Buffett's track record shows an annualized return of about 21% per year, while Utusan scored 47,900% in only eight months time. Now we are talking business ......

Wishing all readers happy holidays.

A Blog about [1] Corporate Governance issues in Malaysia and [2] Global Investment Ideas

Thursday, 24 December 2015

Asian fund managers (4)

BFM interview with James Hay from the Pangolin Fund.

Some of the subjects:

Some of the subjects:

- Nestle

- Public Bank

- Malaysia shunned at the moment, might indicate opportunity

- Hup Seng

- Padini

- Dairy Farm

- Excellent corporate governance

- Avoiding GLCs like Maybank, would these companies be able to compete outside Malaysia?

- Stressing importance of research, also on the ground

Wednesday, 16 December 2015

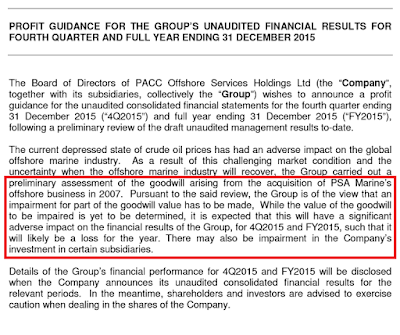

Maybulk: large paperlosses on its investment in POSH (4)

I wrote before:

- POSH should write down its intangibles, which will decrease its book value

- Maybulk should impair it's investment in POSH, it should have marked to market it's investment.

There are some indications that the above might (finally) happen, at least to some degree.

From POSH's latest announcement:

From Maybulk's latest quarterly announcement:

That will not give any consolation to current shareholders in any of these two companies, especially since the normal operations of both companies will be rather bad, due to the current economic environment in both the shipping and oil & gas industry. For the shareholders it will be a case of "when it rains, it pours".

But after the impairments the balance sheet of both companies will give at least a somewhat more realistic picture, something that was overdue for quite some time.

Tuesday, 15 December 2015

1MDB needs a new script (3)

I wrote before about Avestra Asset Management and its curious relationship with 1MDB (here and here).

The Australian published today an article "Court shuts Avestra schemes linked to 1MDB crisis" on its website that seems relevant.

The Federal Court has ordered the shutdown of five investment schemes run by Avestra Asset Management, a Gold Coast financial services group drawn into Malaysia’s 1MDB crisis.

Judge Jonathan Beach made the orders after reading a report from provisional liquidators that found undisclosed related-party transactions, 13 potential breaches of corporate law and failure to invest according to the fund’s individual mandates.

The report, compiled by Simon Wallace-Smith and Richard Hughes of Deloitte and released to The Australian by the court, also reveals that a Cayman Islands vehicle linked to the 1MDB scandal is the owner of the Avestra Credit Fund, which backed a takeover bid against Malaysian company Harvest Court Industries.

The Australian published today an article "Court shuts Avestra schemes linked to 1MDB crisis" on its website that seems relevant.

The Federal Court has ordered the shutdown of five investment schemes run by Avestra Asset Management, a Gold Coast financial services group drawn into Malaysia’s 1MDB crisis.

Judge Jonathan Beach made the orders after reading a report from provisional liquidators that found undisclosed related-party transactions, 13 potential breaches of corporate law and failure to invest according to the fund’s individual mandates.

The report, compiled by Simon Wallace-Smith and Richard Hughes of Deloitte and released to The Australian by the court, also reveals that a Cayman Islands vehicle linked to the 1MDB scandal is the owner of the Avestra Credit Fund, which backed a takeover bid against Malaysian company Harvest Court Industries.

Monday, 14 December 2015

Cooking the books can only last 2 years

Interesting article in The Economist "How companies massage their profits to beat market forecasts", some snippets:

Executives have every incentive to match or beat forecasts as the market punishes those that fail to do so. That, in turn, hurts the value of the share options which are the best hope of making the executives rich.

A recent academic paper looks in detail at this process (The Valuation Premium for a String of Positive Earnings Surprises: The Role of Earnings Manipulation by Jenny Chu, Patricia Dechow, Kai Wai Hui and Annika Yu Wang). As the authors point out, it is hard to know whether the ability of the corporate sector to beat forecasts is due to good management, a growing economy or outright manipulation. So they focus on companies that the SEC has identified as indulging in manipulation.

Sure enough they find that 53% of such firms have a record of four straight quarters of beating forecasts, compared with just 43% of all firms. Secondly, they find that firms tend to indulge in earnings manipulation when they already have a high stock market multiple; they are trying to prop up their share price, not inflate it. The average price-earnings ratio during the manipulation period is 35.

Third, they find that 42% of manipulating firms beat profits for eight quarters, compared with 32% of all firms. After that, the difference is not statistically significant. So two years seems to be the limit for cooking the books. And fourth, they find that executives focus more on beating forecasts than on beating last year's numbers.

The link to the research paper can be found here.

Executives have every incentive to match or beat forecasts as the market punishes those that fail to do so. That, in turn, hurts the value of the share options which are the best hope of making the executives rich.

A recent academic paper looks in detail at this process (The Valuation Premium for a String of Positive Earnings Surprises: The Role of Earnings Manipulation by Jenny Chu, Patricia Dechow, Kai Wai Hui and Annika Yu Wang). As the authors point out, it is hard to know whether the ability of the corporate sector to beat forecasts is due to good management, a growing economy or outright manipulation. So they focus on companies that the SEC has identified as indulging in manipulation.

Sure enough they find that 53% of such firms have a record of four straight quarters of beating forecasts, compared with just 43% of all firms. Secondly, they find that firms tend to indulge in earnings manipulation when they already have a high stock market multiple; they are trying to prop up their share price, not inflate it. The average price-earnings ratio during the manipulation period is 35.

Third, they find that 42% of manipulating firms beat profits for eight quarters, compared with 32% of all firms. After that, the difference is not statistically significant. So two years seems to be the limit for cooking the books. And fourth, they find that executives focus more on beating forecasts than on beating last year's numbers.

The link to the research paper can be found here.

Sunday, 13 December 2015

Malaysia 5th in illicit financial outflows

Global Financial Integrity published its "Illicit Financial Flows from Developing Countries: 2004-2013".

Unfortunately, Malaysia features in the Top 10:

Things get even worse when we take the size of the population in consideration, on a per capita basis Malaysia might even top the list. Not something to be proud of.

The list uses data until 2013. I hope that things have improved since, but taking into consideration how recent developments have been going, I have some strong doubts.

Unfortunately, Malaysia features in the Top 10:

Things get even worse when we take the size of the population in consideration, on a per capita basis Malaysia might even top the list. Not something to be proud of.

The list uses data until 2013. I hope that things have improved since, but taking into consideration how recent developments have been going, I have some strong doubts.

Monday, 7 December 2015

SC punishes audit company

Announcement by the Malaysian Securities Commission:

Audit Oversight Board Revokes Registration of Auditor for the First Time

Announcement by the US Securities and Exchange Commission:

Grant Thornton Ignored Red Flags in Audits

The Securities and Exchange Commission today announced that national audit firm Grant Thornton LLP and two of its partners agreed to settle charges that they ignored red flags and fraud risks while conducting deficient audits of two publicly traded companies that wound up facing SEC enforcement actions for improper accounting and other violations.

Grant Thornton admitted wrongdoing and agreed to forfeit approximately $1.5 million in audit fees and interest plus pay a $3 million penalty.

Melissa Koeppel was an engagement partner on the deficient audits of both companies, and Jeffrey Robinson was an engagement partner on one of the deficient audits, which spanned from 2009 to 2011 and involved senior housing provider Assisted Living Concepts (ALC) and alternative energy company Broadwind Energy. An SEC investigation found that Grant Thornton and the engagement partners repeatedly violated professional standards, and their inaction allowed the companies to make numerous false and misleading public filings.

Pretty similar announcements, one could say, but there are some crucial differences.

The US announcement does name the listed companies, the Malaysian (unfortunately) not. In the latter case the shareholders of the companies involved do not know what happened to the audits, if the management was involved, if any action has to be taken.

Also, there is a very detailed description given in the US case (please visit this website for more information including some links), but not in the Malaysian case.

It is good that some enforcement has been meted out by the Securities Commission, but more information what exactly happened would be helpful.

Audit Oversight Board Revokes Registration of Auditor for the First Time

The Audit Oversight Board (AOB) has revoked the registration of an audit firm Wong Weng Foo & Co along with the Managing Partner, Wong Weng Foo and its Partner, Abdul Halim Husin effective from 2 December 2015.

The revocation is under section 31Q(1)(a)(B) of the Securities Commission Malaysia Act 1993 (SCMA) for failure to remain fit and proper to audit public interest entities.

The SCMA gives AOB the power to revoke the registration of an auditor if the auditor contravenes condition of registrations imposed by the AOB under section 31O(3) of the SCMA.

Wong Weng Foo & Co, Wong Weng Foo and Abdul Halim Husin were found to have failed to comply with auditing standards in the engagement performance of two public listed entities. In addition, Wong Weng Foo & Co failed to carry out the practice honestly, competently and with due care when it failed to implement the remedial action as reported to AOB in respect of past inspection findings.

Wong Weng Foo & Co also failed to ensure that the person who audits the financial statement of a public listed entity on behalf of the audit firm is appropriately qualified, sufficiently trained and competent.

Announcement by the US Securities and Exchange Commission:

Grant Thornton Ignored Red Flags in Audits

The Securities and Exchange Commission today announced that national audit firm Grant Thornton LLP and two of its partners agreed to settle charges that they ignored red flags and fraud risks while conducting deficient audits of two publicly traded companies that wound up facing SEC enforcement actions for improper accounting and other violations.

Grant Thornton admitted wrongdoing and agreed to forfeit approximately $1.5 million in audit fees and interest plus pay a $3 million penalty.

Melissa Koeppel was an engagement partner on the deficient audits of both companies, and Jeffrey Robinson was an engagement partner on one of the deficient audits, which spanned from 2009 to 2011 and involved senior housing provider Assisted Living Concepts (ALC) and alternative energy company Broadwind Energy. An SEC investigation found that Grant Thornton and the engagement partners repeatedly violated professional standards, and their inaction allowed the companies to make numerous false and misleading public filings.

Pretty similar announcements, one could say, but there are some crucial differences.

The US announcement does name the listed companies, the Malaysian (unfortunately) not. In the latter case the shareholders of the companies involved do not know what happened to the audits, if the management was involved, if any action has to be taken.

Also, there is a very detailed description given in the US case (please visit this website for more information including some links), but not in the Malaysian case.

It is good that some enforcement has been meted out by the Securities Commission, but more information what exactly happened would be helpful.

Monday, 30 November 2015

Maxwells Mysterious Marketing

Maxwell International announced their quarterly results, they were simply horrible, a loss of RM 46 Million.

In the notes we can find the following:

When a company increases its advertisement spending by such a large margin, we expect positive results in sales.

But diving in the numbers, it appears that is not exactly what happened:

The company increased its marketing spending by a factor 39 (!) compared to the preceding year, but revenue was down 38%, while gross margin went from 24% to a pathetic 6%.

It all doesn't make any sense whatsoever.

I wrote before about Maxwell, about its puzzling transaction in which it bought a company which it gave back to the original owners two years later for free.

The share price:

In the notes we can find the following:

When a company increases its advertisement spending by such a large margin, we expect positive results in sales.

But diving in the numbers, it appears that is not exactly what happened:

The company increased its marketing spending by a factor 39 (!) compared to the preceding year, but revenue was down 38%, while gross margin went from 24% to a pathetic 6%.

It all doesn't make any sense whatsoever.

I wrote before about Maxwell, about its puzzling transaction in which it bought a company which it gave back to the original owners two years later for free.

The share price:

Sunday, 29 November 2015

Poor earnings growth for Bursa listed companies

My interest was sparked by an (highly readable, if I may add) article "Bits & Pieces - What if?" (February 2015) from CLSA in which it was reported that listed Malaysian companies had performed rather poorly over the last three years, which was expected to continue in 2015:

2012 2013 2014 2015

Sales Growth 6.5% -0.1% -3.7% -6.4%

EBITDA Growth 2.7% -4.7% -3.6% -3.9%

Core Earnings Growth 2.6% -5.5% -11.0% -7.8%

I was rather surprised by this, I knew that numbers were not impressive lately, but this bad?

With some helpful advice and suggestions from others I have tried to reconstruct some of the numbers and update them up to this moment.

The data below comes from the 30 heavyweight stocks from the FBMKLCI 30, representing around 62% of the total Malaysian market capitalisation. The yearly number is the net profit in Millions RM. For companies that have their year end in December I made a rough estimate (in red colour) based on their first nine months of results (good enough for all practical purposes).

If we add the numbers up we find the year-on-year growth:

We notice a rather high growth in 2012, partially explained by the disappointing earnings number of Tenaga in 2011. If that had been (say) three Billion RM higher, then the growth in 2012 would be roughly 6%, which sounds more reasonable.

However, what is striking is the poor results in 2013 and 2014 (about equal to the inflation number, in other words: corrected for inflation zero growth) and negative growth in 2015 (caused primarily by CIMB, IOI and Sime Darby).

These thirty companies are the heavyweight blue chips listed on Bursa Malaysia, one would have expected a much better performance.

Unfortunately things get even worse when we translate the numbers to USD. This is the 5-year graph of the Ringgit versus the US Dollar:

I have added the estimated average rate of the Ringgit in each year and recalculated the net profit in USD and the growth:

The numbers have clearly worsened, growth for 2013 and 2014 is even below inflation, while 2015 has fallen steeply off a cliff.

Is it relevant to calculate the earnings of Malaysian companies in US Dollars?

Yes it is, at least for international fund managers, their fund performance is calculated in US Dollars, and assuming that share prices are in the long run based on fundamentals (one important factor is earnings), those fundamentals should also be calculated in US Dollar.

But even for Malaysians the numbers in USD should carry some weight, many products are imported and priced in USD, to buy them one needs to have earnings in USD.

The above numbers do not look good, and are (partially) to blame for the poor performance of the Malaysian market.

Another issue is that the above numbers seem very much disconnected from the officially reported GDP numbers by the Department of Statistics Malaysia, which show around 5% yearly (real) growth for the years 2011 until 2015.

The correlation is definitely not very high between the two: the 30 companies do not cover all industries equally, the GDP is based on clearly more than corporate earnings or sales, etc.

But in each year the thirty companies earn more than RM 50 Billion net profit, a pretty decent result, which is surely significant for the Malaysian economy.

So one would have expected that if the economy is reported to nicely grow in real terms, that it would be translated in the numbers as reported by the heavyweight listed companies.

2012 2013 2014 2015

Sales Growth 6.5% -0.1% -3.7% -6.4%

EBITDA Growth 2.7% -4.7% -3.6% -3.9%

Core Earnings Growth 2.6% -5.5% -11.0% -7.8%

I was rather surprised by this, I knew that numbers were not impressive lately, but this bad?

With some helpful advice and suggestions from others I have tried to reconstruct some of the numbers and update them up to this moment.

The data below comes from the 30 heavyweight stocks from the FBMKLCI 30, representing around 62% of the total Malaysian market capitalisation. The yearly number is the net profit in Millions RM. For companies that have their year end in December I made a rough estimate (in red colour) based on their first nine months of results (good enough for all practical purposes).

If we add the numbers up we find the year-on-year growth:

We notice a rather high growth in 2012, partially explained by the disappointing earnings number of Tenaga in 2011. If that had been (say) three Billion RM higher, then the growth in 2012 would be roughly 6%, which sounds more reasonable.

However, what is striking is the poor results in 2013 and 2014 (about equal to the inflation number, in other words: corrected for inflation zero growth) and negative growth in 2015 (caused primarily by CIMB, IOI and Sime Darby).

These thirty companies are the heavyweight blue chips listed on Bursa Malaysia, one would have expected a much better performance.

Unfortunately things get even worse when we translate the numbers to USD. This is the 5-year graph of the Ringgit versus the US Dollar:

I have added the estimated average rate of the Ringgit in each year and recalculated the net profit in USD and the growth:

The numbers have clearly worsened, growth for 2013 and 2014 is even below inflation, while 2015 has fallen steeply off a cliff.

Is it relevant to calculate the earnings of Malaysian companies in US Dollars?

Yes it is, at least for international fund managers, their fund performance is calculated in US Dollars, and assuming that share prices are in the long run based on fundamentals (one important factor is earnings), those fundamentals should also be calculated in US Dollar.

But even for Malaysians the numbers in USD should carry some weight, many products are imported and priced in USD, to buy them one needs to have earnings in USD.

The above numbers do not look good, and are (partially) to blame for the poor performance of the Malaysian market.

Another issue is that the above numbers seem very much disconnected from the officially reported GDP numbers by the Department of Statistics Malaysia, which show around 5% yearly (real) growth for the years 2011 until 2015.

The correlation is definitely not very high between the two: the 30 companies do not cover all industries equally, the GDP is based on clearly more than corporate earnings or sales, etc.

But in each year the thirty companies earn more than RM 50 Billion net profit, a pretty decent result, which is surely significant for the Malaysian economy.

So one would have expected that if the economy is reported to nicely grow in real terms, that it would be translated in the numbers as reported by the heavyweight listed companies.

Saturday, 28 November 2015

AirAsia's accounting issues (2)

I wrote before about this issue, more than four years ago:

"AirAsia had previously drawn criticism from many parties as to why it never equity accounted the losses suffered by its associates and there were calls for greater transparency over the financial numbers recorded by the associates. The airline subsequently explained that with AirAsia having written down to zero its investments for both TAA and IAA in AirAsia's balance sheet, it did not need to recognise any further losses made by TAA and IAA as it had no accounting obligation to make good on those losses."

I find the AirAsia's accounting much too aggressive. Thai AirAsia and PT Indonesia AirAsia are two strategic investments in which AirAsia has a large share (almost 50%) and to which AirAsia is lending large amounts of money. Conservative accounting would really require these losses of RM 254 million to be accounted for.

Finally, four years later, AirAsia had to recognize its previous losses in its Indonesian subsidiary when it announced its results:

From the options I gave above, it turned out to be the second option, AirAsia was forced by the Indonesian authorities to replenish the shareholders funds in its Indonesian subsidiary.

This one-off event dragged down the quarterly results substantially, the PBT was a loss of RM 462 Million, almost exactly the prior year absorbed losses.

I concluded my previous posting by:

There is still the other accounting issue, AirAsia has booked as "profits" RM 659 million deferred tax assets. This is tax it does not need to pay in the future if it makes profit. Again, a very aggressive way of accounting.

In other words, AirAsia is not accounting for losses that have occurred in its strategic investments, but it is accounting for possible future profits.

This does not seem right to me.

It still does not seem right to me, although I am not an accountant.

AirAsia did not incur those losses the last quarter, what they did was invest more money in their subsidiary.

By not recognizing the losses they have (in my opinion) artificially boosted their earnings over those years, but now they finally had to account for it (at least for their Indonesian subsidiary).

"AirAsia had previously drawn criticism from many parties as to why it never equity accounted the losses suffered by its associates and there were calls for greater transparency over the financial numbers recorded by the associates. The airline subsequently explained that with AirAsia having written down to zero its investments for both TAA and IAA in AirAsia's balance sheet, it did not need to recognise any further losses made by TAA and IAA as it had no accounting obligation to make good on those losses."

I find the AirAsia's accounting much too aggressive. Thai AirAsia and PT Indonesia AirAsia are two strategic investments in which AirAsia has a large share (almost 50%) and to which AirAsia is lending large amounts of money. Conservative accounting would really require these losses of RM 254 million to be accounted for.

There are several possible outcomes, in each of it AirAsia has to take the loss:

- Their Thai or Indonesian operation goes bankrupt, in this case AirAsia has to write off its loans

- The equity of their Thai or Indonesia operation is replenished, AirAsia has to write of its losses

- The Thai or Indonesian operation turns highly profitable, again AirAsia has to write of its previous losses against these profits

Finally, four years later, AirAsia had to recognize its previous losses in its Indonesian subsidiary when it announced its results:

From the options I gave above, it turned out to be the second option, AirAsia was forced by the Indonesian authorities to replenish the shareholders funds in its Indonesian subsidiary.

This one-off event dragged down the quarterly results substantially, the PBT was a loss of RM 462 Million, almost exactly the prior year absorbed losses.

I concluded my previous posting by:

There is still the other accounting issue, AirAsia has booked as "profits" RM 659 million deferred tax assets. This is tax it does not need to pay in the future if it makes profit. Again, a very aggressive way of accounting.

In other words, AirAsia is not accounting for losses that have occurred in its strategic investments, but it is accounting for possible future profits.

This does not seem right to me.

It still does not seem right to me, although I am not an accountant.

AirAsia did not incur those losses the last quarter, what they did was invest more money in their subsidiary.

By not recognizing the losses they have (in my opinion) artificially boosted their earnings over those years, but now they finally had to account for it (at least for their Indonesian subsidiary).

AirAsia X has booked RM 470 Million in "profits" due to deferred tax assets while it has not booked a single year of "normalized earnings" (corrected for one-off items) in its existence.

AirAsia and AirAsia X might have convinced their auditor who signed the accounts over those years, but they haven't convinced me. Surely this can not be the correct way to do things.

Thursday, 26 November 2015

AirAsia X: is the rights issue enough? (4)

I wrote before about the upcoming rights issue of AirAsia X and asked the question if the money (RM 395 Million) is enough:

"The company has been bleeding lots of money (if one takes out one-off items and does not take deferred taxation into account, then AirAsia X lost money in every single year of its existence). Also, the company has large capital commitments."

AirAsia X announced its third quarterly results, and the loss for the year increased further to RM 562 Million, much larger than the recently completed rights issue.

On one side a large part of the losses (RM 357 Million) is due to foreign exchange losses, due to the weak Ringgit.

On the other hand, the company spend RM 371 Million less on fuel, due to the softening of the oil price.

Its shareholder equity is RM 503 Million, about equal to its deferred tax assets (RM 470 Million), which should (in my opinion) not be counted as an asset. In other words, without the deferred tax assets the shareholder equity would be very close to zero.

It looks like the company needs a huge injection of fresh capital, but another rights issue, so soon after its previous one, might be hard to digest for the minority shareholders.

"The company has been bleeding lots of money (if one takes out one-off items and does not take deferred taxation into account, then AirAsia X lost money in every single year of its existence). Also, the company has large capital commitments."

AirAsia X announced its third quarterly results, and the loss for the year increased further to RM 562 Million, much larger than the recently completed rights issue.

On one side a large part of the losses (RM 357 Million) is due to foreign exchange losses, due to the weak Ringgit.

On the other hand, the company spend RM 371 Million less on fuel, due to the softening of the oil price.

Its shareholder equity is RM 503 Million, about equal to its deferred tax assets (RM 470 Million), which should (in my opinion) not be counted as an asset. In other words, without the deferred tax assets the shareholder equity would be very close to zero.

It looks like the company needs a huge injection of fresh capital, but another rights issue, so soon after its previous one, might be hard to digest for the minority shareholders.

Monday, 23 November 2015

Proven Oil Asia in trouble? (2)

Five days after my last posting the MAS (Monetary Authority of Singapore) put the Capital Asia Group on their "Investor Alert List":

The company still advertises the Proven Oil Asia scheme on their website, mentioning "high returns from secure investments", "proven track record / non speculative", "proven strength of Conserve Oil Group Inc.":

The company still advertises the Proven Oil Asia scheme on their website, mentioning "high returns from secure investments", "proven track record / non speculative", "proven strength of Conserve Oil Group Inc.":

Thursday, 12 November 2015

Proven Oil Asia in trouble?

I have written several times about Proven Oil Asia.

The reason I wrote about this investment scheme was that a very similar one (Proven Oil Canada) in Germany seemed to have run in problems. Many of the names connected to the two schemes were the same. At the very least I had expected the authorities to have a close look at the scheme.

Both the Securities Commission and Bank Negara in Malaysia did indeed take action, Focus Malaysia and Kinibiz have written articles about the scheme.

In Singapore however I have not noticed any action whatsoever from the authorities, the media have also not given it any attention.

That might have been a mistake.

From recent information it looks like not only Proven Oil Canada but also Proven Oil Asia has run in some serious troubles.

MNP Ltd. ("one of Canada’s leading firms in Corporate Recovery & Restructuring") has a webpage devoted to Conserve Oil Group Inc., COGI Limited Partnership and Canadian Oil & Gas International. On October 26, 2015, MNP Ltd. was appointed as Receiver and Manager of these three companies.

Of interest are several of the articles listed on the webpage, for instance this one, some excerpts:

The difficult structure of companies:

The convoluted structure might be a headache to unravel for investors in the schemes, but a field day for the lawyers involved.

In Germany a group has been formed by investors in the Proven Oil Canada scheme, the website is mostly in German, but Google Translate might help.

The reason I wrote about this investment scheme was that a very similar one (Proven Oil Canada) in Germany seemed to have run in problems. Many of the names connected to the two schemes were the same. At the very least I had expected the authorities to have a close look at the scheme.

Both the Securities Commission and Bank Negara in Malaysia did indeed take action, Focus Malaysia and Kinibiz have written articles about the scheme.

In Singapore however I have not noticed any action whatsoever from the authorities, the media have also not given it any attention.

That might have been a mistake.

From recent information it looks like not only Proven Oil Canada but also Proven Oil Asia has run in some serious troubles.

MNP Ltd. ("one of Canada’s leading firms in Corporate Recovery & Restructuring") has a webpage devoted to Conserve Oil Group Inc., COGI Limited Partnership and Canadian Oil & Gas International. On October 26, 2015, MNP Ltd. was appointed as Receiver and Manager of these three companies.

Of interest are several of the articles listed on the webpage, for instance this one, some excerpts:

Another article with some excerpts:

The difficult structure of companies:

The convoluted structure might be a headache to unravel for investors in the schemes, but a field day for the lawyers involved.

In Germany a group has been formed by investors in the Proven Oil Canada scheme, the website is mostly in German, but Google Translate might help.

Tuesday, 10 November 2015

When will Hibiscus bloom? (3)

From the previous posting about this subject:

".... the Company believes that there may be some shareholders who have been subject to margin calls on shares that have been collateralised and are being asked to regularise their margin positions."

It looks like at least one party has been revealed who was selling in the market due to margin calls, according to this announcement:

MERCURY PACIFIC MARINE PTE LTD

No of securities disposed 45,923,900

Circumstances by reason of which Securities Holder has interest Disposal on open market due to margin call forced selling

Hibiscus' shares were suspended yesterday, for the fifth time this year:

3D Oil (Hibiscus invested in the company and partially funds the exploration of the Sea Lion project) had a rather bad announcement today:

Its share price plunged 33% today:

".... the Company believes that there may be some shareholders who have been subject to margin calls on shares that have been collateralised and are being asked to regularise their margin positions."

It looks like at least one party has been revealed who was selling in the market due to margin calls, according to this announcement:

MERCURY PACIFIC MARINE PTE LTD

No of securities disposed 45,923,900

Circumstances by reason of which Securities Holder has interest Disposal on open market due to margin call forced selling

Hibiscus' shares were suspended yesterday, for the fifth time this year:

3D Oil (Hibiscus invested in the company and partially funds the exploration of the Sea Lion project) had a rather bad announcement today:

Its share price plunged 33% today:

Wednesday, 4 November 2015

Scan: sloppy announcement

I wrote before about Scan Associates' rather "frivolous" legal action against Bursa Malaysia.

The company made the following announcement:

Four times the term "Material Litigation".

But, as detailed in an announcement the following day, it actually concerns a "Letter of Demand".

A case of rather sloppy reporting.

Of a much more serious nature was the announcement last week"

"The directors wish to announce that the auditors were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the Company’s and Group’s financial statements for the period ended 30 June 2015."

Next to that, there are the very serious allegations against the ex-CEO and ex-CFO.

The company is losing money badly, and has a negative net asset value. A miracle is needed, soon.

The company made the following announcement:

Four times the term "Material Litigation".

But, as detailed in an announcement the following day, it actually concerns a "Letter of Demand".

A case of rather sloppy reporting.

Of a much more serious nature was the announcement last week"

"The directors wish to announce that the auditors were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the Company’s and Group’s financial statements for the period ended 30 June 2015."

Next to that, there are the very serious allegations against the ex-CEO and ex-CFO.

The company is losing money badly, and has a negative net asset value. A miracle is needed, soon.

Tuesday, 3 November 2015

When will Hibiscus bloom? (2)

I wrote before about this subject, and in general about Hibiscus in a rather sceptical way.

I don't know if Hibiscus will ever bloom again, and if so when, but definitely not today.

Hibiscus' share price dropped steeply, way below its IPO price:

In an answer to an "UMA" (Unusual Market Activity) query by Bursa, the company replied:

".... the Company believes that there may be some shareholders who have been subject to margin calls on shares that have been collateralised and are being asked to regularise their margin positions."

Added to that, the short term outlook for Oil & Gas does not look good, the RM has depreciated against the USD and the company has never made an operational profit in its existence.

I don't know if Hibiscus will ever bloom again, and if so when, but definitely not today.

Hibiscus' share price dropped steeply, way below its IPO price:

In an answer to an "UMA" (Unusual Market Activity) query by Bursa, the company replied:

".... the Company believes that there may be some shareholders who have been subject to margin calls on shares that have been collateralised and are being asked to regularise their margin positions."

Added to that, the short term outlook for Oil & Gas does not look good, the RM has depreciated against the USD and the company has never made an operational profit in its existence.

Thursday, 22 October 2015

Short sellers active again (2)

The ink was not yet dry of my previous posting while Glaucus Research posted their short seller report about Real Nutriceutical Group Limited (HK: 2010).

The share is down about 9% at the moment.

Many of the allegations in the report touch on similar concerns related to many of the China listed companies on Bursa.

The share is down about 9% at the moment.

Many of the allegations in the report touch on similar concerns related to many of the China listed companies on Bursa.

Short sellers active again

Short seller Citron Research dropped a "bomb" on Valeant, a pharmaceutical company, the report can be found here.

Interestingly, well known hedge fund manager Bill Ackman is "long" the stock. Ackman himself is short Herbalife.

Bronte Capital wrote "Some comments on the Valeant conference call".

Bloomberg reports: "Ackman Feeling Shortseller's Sting as Citron Sinks Valeant Stock", a snippet:

Ackman, the billionaire hedge fund manager, has long maintained that Herbalife Ltd. is a house of cards -- a suggestion that’s drawn howls from the company. Now another Wall Street scold, Citron Research’s Andrew Left, says one of Ackman’s picks looks like the Enron Corp. of Big Pharma -- a claim the company, Valeant Pharmaceuticals International Inc., rebutted Wednesday.

Yet as Valeant’s share price plunged anew, Ackman was, in effect, getting a small taste of his own medicine. Left, a small-time short seller, had grabbed headlines and captivated Wall Street, much as Ackman has done with his campaign against Herbalife. While this dust-up might seem lopsided -- Ackman runs a prominent hedge fund, Left a relatively obscure investment and research shop -- it nonetheless underscored how vocal short-sellers can gain attention and turn markets against companies fast.

“If there’s one person in the world I don’t feel bad for, it’s Bill Ackman,” Left, a 45-year-old Florida native based in Los Angeles, said in a telephone interview. “If I could switch bank accounts and hair with him, I’d close out tomorrow. Ackman’s a hedge fund manager who goes short and goes long and sometimes you win, sometimes you lose.”

Assuming there’s been no change in its holdings since the end of the second quarter, Ackman’s Pershing Square Capital Management has lost about $2.8 billion on Valeant as it declined 55 percent from an intraday peak of $263.81 on Aug. 6, according to data compiled by Bloomberg.

“In this business, nothing is personal,” Left said. “He goes home and sees his kids, I go home and see mine, and he does what he believes with his opinion.”

Biggest Selloff

If people had never heard of Citron Research before, they have now. Just after 10 a.m. Wednesday, the firm published a note suggesting Valeant was inflating its sales, igniting the biggest selloff anyone had ever seen in the stock. Laval, Quebec-based Valeant plunged as much as 40 percent, prompting a public response from the company and creating billions of dollars of losses for its hedge fund owners.

In a statement, Valeant said Citron’s research is “erroneous” and that the company derives no sales benefit from inventory held at specialty pharmacies mentioned in the report. It suggested Citron had reached inaccurate conclusions, misconstruing links between them that are explained by logistics and support agreements.

Past foes of Ackman saw irony that a company he’s invested in was sent reeling by a short-seller claiming that its revenue is overstated. Citron, the decade-old stock-commentary site originally founded as Stocklemon.com, said Valeant is using a specialty pharmacy called Philidor RX Services to store inventory and record those transactions as sales. “Is this Enron part deux?” the report said.

Just last week Muddy Waters wrote a scathing report about TeliaSonera, a Swedish telco involved in corruption which is, according to Muddy Waters, much larger than reported so far.

Interestingly, well known hedge fund manager Bill Ackman is "long" the stock. Ackman himself is short Herbalife.

Bronte Capital wrote "Some comments on the Valeant conference call".

Bloomberg reports: "Ackman Feeling Shortseller's Sting as Citron Sinks Valeant Stock", a snippet:

Ackman, the billionaire hedge fund manager, has long maintained that Herbalife Ltd. is a house of cards -- a suggestion that’s drawn howls from the company. Now another Wall Street scold, Citron Research’s Andrew Left, says one of Ackman’s picks looks like the Enron Corp. of Big Pharma -- a claim the company, Valeant Pharmaceuticals International Inc., rebutted Wednesday.

Yet as Valeant’s share price plunged anew, Ackman was, in effect, getting a small taste of his own medicine. Left, a small-time short seller, had grabbed headlines and captivated Wall Street, much as Ackman has done with his campaign against Herbalife. While this dust-up might seem lopsided -- Ackman runs a prominent hedge fund, Left a relatively obscure investment and research shop -- it nonetheless underscored how vocal short-sellers can gain attention and turn markets against companies fast.

“If there’s one person in the world I don’t feel bad for, it’s Bill Ackman,” Left, a 45-year-old Florida native based in Los Angeles, said in a telephone interview. “If I could switch bank accounts and hair with him, I’d close out tomorrow. Ackman’s a hedge fund manager who goes short and goes long and sometimes you win, sometimes you lose.”

Assuming there’s been no change in its holdings since the end of the second quarter, Ackman’s Pershing Square Capital Management has lost about $2.8 billion on Valeant as it declined 55 percent from an intraday peak of $263.81 on Aug. 6, according to data compiled by Bloomberg.

“In this business, nothing is personal,” Left said. “He goes home and sees his kids, I go home and see mine, and he does what he believes with his opinion.”

Biggest Selloff

If people had never heard of Citron Research before, they have now. Just after 10 a.m. Wednesday, the firm published a note suggesting Valeant was inflating its sales, igniting the biggest selloff anyone had ever seen in the stock. Laval, Quebec-based Valeant plunged as much as 40 percent, prompting a public response from the company and creating billions of dollars of losses for its hedge fund owners.

In a statement, Valeant said Citron’s research is “erroneous” and that the company derives no sales benefit from inventory held at specialty pharmacies mentioned in the report. It suggested Citron had reached inaccurate conclusions, misconstruing links between them that are explained by logistics and support agreements.

Past foes of Ackman saw irony that a company he’s invested in was sent reeling by a short-seller claiming that its revenue is overstated. Citron, the decade-old stock-commentary site originally founded as Stocklemon.com, said Valeant is using a specialty pharmacy called Philidor RX Services to store inventory and record those transactions as sales. “Is this Enron part deux?” the report said.

Just last week Muddy Waters wrote a scathing report about TeliaSonera, a Swedish telco involved in corruption which is, according to Muddy Waters, much larger than reported so far.

Tuesday, 20 October 2015

IPOs leaning too heavily on cornerstones

From Reuters:

In construction, the cornerstone is an all-important component of a new building. In capital markets, it’s an investor that helps support the value of a company before its initial public offering. In Hong Kong, these cornerstones are bearing too much of the load and undermining the foundation of the local stock market.

In principle, there’s nothing wrong with companies pre-selling some shares to big investors ahead of an IPO. Fund managers ensure they get a decent allocation in return for agreeing not to sell for six months. For the listing company, the endorsement of a shrewd backer can help stimulate interest from smaller shareholders.

The practice in Hong Kong is spinning out of control, however. Big companies preparing to sell shares now routinely pledge half or more of them to friendly investors. Take China Huarong Asset Management, the state-owned “bad bank” that is seeking to raise between $2.3 billion and $2.5 billion. It already has commitments worth $1.6 billion from 10 investors, according to a term sheet describing the deal. That’s more than two-thirds of the total at the middle of the price range.

Huarong isn’t alone either. Cornerstone investors have pledged $1.1 billion to China Reinsurance, which is targeting up to $2 billion. Of the 28 Hong Kong listings that have raised more than $500 million since the beginning of 2013, the average allocation to cornerstone investors was 40 percent, according to Breakingviews calculations. Giving a small group of buyers such large slugs creates an overhang that weighs on the share price.

The cosy arrangement also undermines the whole concept of a public offering. Huarong’s biggest cornerstones are not professional money managers but developer Sino-Ocean Land and China’s State Grid, which is also backing China Re. When one state-backed Chinese company invests in another, getting the best available return on investment may not be the only consideration.

After a botched bailout of the stock market over the summer, the money-go-round in Hong Kong is another example of how state influence can distort public markets. Buildings may depend on the support of a cornerstone. Hong Kong’s exchange participants would do better to start chiseling away at them.

The above is also very relevant in the Malaysian context. Suddenly a few years ago the term "cornerstone investor" was introduced.

Another concept that also doesn't work is artificial holding up the price in the month after the IPO.

In construction, the cornerstone is an all-important component of a new building. In capital markets, it’s an investor that helps support the value of a company before its initial public offering. In Hong Kong, these cornerstones are bearing too much of the load and undermining the foundation of the local stock market.

In principle, there’s nothing wrong with companies pre-selling some shares to big investors ahead of an IPO. Fund managers ensure they get a decent allocation in return for agreeing not to sell for six months. For the listing company, the endorsement of a shrewd backer can help stimulate interest from smaller shareholders.

The practice in Hong Kong is spinning out of control, however. Big companies preparing to sell shares now routinely pledge half or more of them to friendly investors. Take China Huarong Asset Management, the state-owned “bad bank” that is seeking to raise between $2.3 billion and $2.5 billion. It already has commitments worth $1.6 billion from 10 investors, according to a term sheet describing the deal. That’s more than two-thirds of the total at the middle of the price range.

Huarong isn’t alone either. Cornerstone investors have pledged $1.1 billion to China Reinsurance, which is targeting up to $2 billion. Of the 28 Hong Kong listings that have raised more than $500 million since the beginning of 2013, the average allocation to cornerstone investors was 40 percent, according to Breakingviews calculations. Giving a small group of buyers such large slugs creates an overhang that weighs on the share price.

The cosy arrangement also undermines the whole concept of a public offering. Huarong’s biggest cornerstones are not professional money managers but developer Sino-Ocean Land and China’s State Grid, which is also backing China Re. When one state-backed Chinese company invests in another, getting the best available return on investment may not be the only consideration.

After a botched bailout of the stock market over the summer, the money-go-round in Hong Kong is another example of how state influence can distort public markets. Buildings may depend on the support of a cornerstone. Hong Kong’s exchange participants would do better to start chiseling away at them.

The above is also very relevant in the Malaysian context. Suddenly a few years ago the term "cornerstone investor" was introduced.

Another concept that also doesn't work is artificial holding up the price in the month after the IPO.

Friday, 9 October 2015

1MDB needs a new script (2)

I wrote before about the rather curious relationship between 1MDB and Avestra, an asset management company that seems to be managed from a townhouse in the Gold Coast, Australia.

It has been mentioned several times in the press "Australian firm Avestra Asset Management has been managing over US$2 billion of 1Malaysia Development Bhd's monies invested in several Cayman Islands funds."

It must be noted that 1MDB has never denied the above.

Avestra was fined in the past by ASIC having committed six offences, and being mentioned by hard-hitting blogger "Dr Benway" in a not "very positive way", to put it mildly.

But things are about to get much stranger according to this press release:

ASIC seeks court orders to wind up Avestra Asset Management

ASIC has commenced proceedings in the Federal Court of Australia against Avestra Asset Management Ltd (Avestra), the holder of an Australian financial services licence and responsible entity or trustee of a number of managed investment schemes. Avestra's schemes are managed funds which invest in shares and other financial products. ASIC understands the schemes comprise approximately $18.5 million under management.

ASIC alleges that Avestra has persistently contravened its duties in relation to a number of the schemes, including to:

Among other things, ASIC alleges that Avestra borrowed money on an unsecured basis from the property of its schemes, and invested scheme property in entities and offshore funds connected to its directors without proper due diligence or regard for the interests of members.

ASIC is seeking interim orders to appoint provisional liquidators or receivers to take control of Avestra's assets and report on, among other things, any suspected contraventions of the law, any losses suffered by scheme members, and whether the schemes ought to continue in operation (under a new responsible entity) or whether they should also be wound up.

ASIC is seeking final orders that Avestra be wound up on a just and equitable basis.

According to this article there are clear links with Malaysia, in particular Harvest Court Industries, Eddie Chai and several ACE listed companies:

ASIC: Avestra ‘diverted cash to tax haven’

The corporate watchdog has accused management of Gold Coast funds management group Avestra of diverting investors’ money to unregulated entities in tax haven the Cayman Islands and using fund money to prop up a timber tycoon’s controversial takeover bid for a Malaysian company.

In a blockbuster 200-page Federal Court affidavit, Australian Securities & Investments Commission senior investigator Glenn Childs details the regulator’s concerns about failures to disclose related party transactions, potential breaches of takeover laws and the plummeting value of Avestra’s investments.

Mr Childs said he was concerned that Avestra Asset Management executives Paul Rowles and Clay Dempsey “may not be fit to act as the responsible managers” of the company and “investor funds may be at risk”. The company controls about $18.5 million of investors’ money.

Earlier this month, ASIC asked the court to appoint Simon Wallace-Smith and Robert Woods of Deloitte as provisional liquidators of Avestra with a mandate to take control of the 13 funds run by the group.

Justice Jonathan Beach on Thursday ordered the application be heard on October 27.

Avestra has yet to file a defence and its solicitor, Angela Yates of Moray Agnew, declined to comment because the case is before the court.

Mr Childs’s affidavit reveals that Avestra has been the subject of a full-scale ASIC investigation since December 2014.

He alleges Avestra began moving money to the Cayman Islands funds in May last year after ASIC began inquiring into management of its Australian wholesale funds.

Avestra allegedly closed the Australian wholesale funds — Canton, Worberg and Safecrest — and opened equivalents in the tax haven, Bridge Global CMC and Hanhong High Yield.

However, the underlying investments, allegedly dominated by risky punts on Malaysian second-bourse stocks [most likely the writer means the ACE market], did not change.

Mr Childs alleges that one of the funds into which investor money was channelled, the Avestra Credit Fund, failed to disclose a series of investments that involved conflicts of interest.

The largest was $US5.4m, about three quarters of the fund’s assets, loaned in May last year to Zenith City Investments, a company registered in tax haven Seychelles and run by Malaysian businessman Eddie Chai.

“The circumstances in which the loan to Zenith was made suggest that it may have been used for an attempt by Zenith and its director (Mr Chai) … for an attempt to take over the board of Harvest Court Industries … a company listed on the main market of the Malaysia Bursa,” Mr Childs said.

At the same time, Avestra “itself acquired a significant holding in Harvest Court Industries on behalf of its various schemes”, he added.

Under examination by ASIC, Mr Rowles denied knowing Mr Chai wanted the money to buy more stock in Harvest Court.

Mr Chai succeeded in his takeover bid but it was controversial, sparking a Malaysian High Court case.

The Malaysian regulators (BM and/or SC) might want to take note of the above, several Bursa listed companies do indeed have Avestra as an investor.

Two of the funds that are being managed by Avestra have the following track record according to information from their own website:

In a bit more than one year, the funds NAV price lost 60% of its value.

And this fund lost 46% of its NAV price in only nine months time.

According to its website the company delivers "superior performance", but I can't find any proof of that, in the contrary. I only notice a very bad performance and a extreme volatile NAV price. Losing 40% respectively 34% in a single month is simply beyond my believe.

1MDB is not invested in these two funds, that will be of some relief to Malaysian taxpayers.

But it still leaves important questions, for instance:

It has been mentioned several times in the press "Australian firm Avestra Asset Management has been managing over US$2 billion of 1Malaysia Development Bhd's monies invested in several Cayman Islands funds."

It must be noted that 1MDB has never denied the above.

Avestra was fined in the past by ASIC having committed six offences, and being mentioned by hard-hitting blogger "Dr Benway" in a not "very positive way", to put it mildly.

But things are about to get much stranger according to this press release:

ASIC seeks court orders to wind up Avestra Asset Management

ASIC has commenced proceedings in the Federal Court of Australia against Avestra Asset Management Ltd (Avestra), the holder of an Australian financial services licence and responsible entity or trustee of a number of managed investment schemes. Avestra's schemes are managed funds which invest in shares and other financial products. ASIC understands the schemes comprise approximately $18.5 million under management.

ASIC alleges that Avestra has persistently contravened its duties in relation to a number of the schemes, including to:

- act in the best interests of scheme members

- exercise the required degree of care and diligence

- do all things necessary to ensure that the financial services provided under its licence are provided efficiently, honestly and fairly.

Among other things, ASIC alleges that Avestra borrowed money on an unsecured basis from the property of its schemes, and invested scheme property in entities and offshore funds connected to its directors without proper due diligence or regard for the interests of members.

ASIC is seeking interim orders to appoint provisional liquidators or receivers to take control of Avestra's assets and report on, among other things, any suspected contraventions of the law, any losses suffered by scheme members, and whether the schemes ought to continue in operation (under a new responsible entity) or whether they should also be wound up.

ASIC is seeking final orders that Avestra be wound up on a just and equitable basis.

According to this article there are clear links with Malaysia, in particular Harvest Court Industries, Eddie Chai and several ACE listed companies:

ASIC: Avestra ‘diverted cash to tax haven’

The corporate watchdog has accused management of Gold Coast funds management group Avestra of diverting investors’ money to unregulated entities in tax haven the Cayman Islands and using fund money to prop up a timber tycoon’s controversial takeover bid for a Malaysian company.

In a blockbuster 200-page Federal Court affidavit, Australian Securities & Investments Commission senior investigator Glenn Childs details the regulator’s concerns about failures to disclose related party transactions, potential breaches of takeover laws and the plummeting value of Avestra’s investments.

Mr Childs said he was concerned that Avestra Asset Management executives Paul Rowles and Clay Dempsey “may not be fit to act as the responsible managers” of the company and “investor funds may be at risk”. The company controls about $18.5 million of investors’ money.

Earlier this month, ASIC asked the court to appoint Simon Wallace-Smith and Robert Woods of Deloitte as provisional liquidators of Avestra with a mandate to take control of the 13 funds run by the group.

Justice Jonathan Beach on Thursday ordered the application be heard on October 27.

Avestra has yet to file a defence and its solicitor, Angela Yates of Moray Agnew, declined to comment because the case is before the court.

Mr Childs’s affidavit reveals that Avestra has been the subject of a full-scale ASIC investigation since December 2014.

He alleges Avestra began moving money to the Cayman Islands funds in May last year after ASIC began inquiring into management of its Australian wholesale funds.

Avestra allegedly closed the Australian wholesale funds — Canton, Worberg and Safecrest — and opened equivalents in the tax haven, Bridge Global CMC and Hanhong High Yield.

However, the underlying investments, allegedly dominated by risky punts on Malaysian second-bourse stocks [most likely the writer means the ACE market], did not change.

Mr Childs alleges that one of the funds into which investor money was channelled, the Avestra Credit Fund, failed to disclose a series of investments that involved conflicts of interest.

The largest was $US5.4m, about three quarters of the fund’s assets, loaned in May last year to Zenith City Investments, a company registered in tax haven Seychelles and run by Malaysian businessman Eddie Chai.

“The circumstances in which the loan to Zenith was made suggest that it may have been used for an attempt by Zenith and its director (Mr Chai) … for an attempt to take over the board of Harvest Court Industries … a company listed on the main market of the Malaysia Bursa,” Mr Childs said.

At the same time, Avestra “itself acquired a significant holding in Harvest Court Industries on behalf of its various schemes”, he added.

Under examination by ASIC, Mr Rowles denied knowing Mr Chai wanted the money to buy more stock in Harvest Court.

Mr Chai succeeded in his takeover bid but it was controversial, sparking a Malaysian High Court case.

The Malaysian regulators (BM and/or SC) might want to take note of the above, several Bursa listed companies do indeed have Avestra as an investor.

Two of the funds that are being managed by Avestra have the following track record according to information from their own website:

In a bit more than one year, the funds NAV price lost 60% of its value.

And this fund lost 46% of its NAV price in only nine months time.

According to its website the company delivers "superior performance", but I can't find any proof of that, in the contrary. I only notice a very bad performance and a extreme volatile NAV price. Losing 40% respectively 34% in a single month is simply beyond my believe.

1MDB is not invested in these two funds, that will be of some relief to Malaysian taxpayers.

But it still leaves important questions, for instance:

- Did 1MDB invest in a fund managed by Avestra, if so who was responsible for the due diligence of selecting the fund manager, and how was that process exactly performed? Did the due diligence result in any red flags?

- Which fund did 1MDB exactly invest in, and what have the returns been so far?

- Is any commission paid to an agent (or other person/organisation) when 1MDB made this investment, if so how much?

Thursday, 8 October 2015

Why Protecting Minority Shareholders Builds Stock Markets

From Wharton university:

Once upon a time, only countries like Britain and the United States had legal provisions in place to protect the rights of minority shareholders against the actions and decisions of large shareholders and management. As a result, money flowed into the stock market, and capitalization grew vigorously, dwarfing all other markets around the world. Beginning in the 1980s, however, countries in Continental Europe and Asia introduced reforms in their corporate legislation, affording minority shareholders a number of legal protections, including boosting the powers of the general shareholders’ meeting, prohibiting multiple voting rights and dual-class shares, mandating the presence of independent directors, and requiring the disclosure of major equity stakes, among others. What has driven these changes? Have they resulted in the growth of the stock market?

A new paper by Mauro F. Guillén of the Wharton School and Laurence Capron of INSEAD sheds light on these important issues.* They have assembled information on legal protections for minority shareholders in as many as 78 countries since 1970. They document that whereas four decades ago the Anglo Saxon countries afforded minority shareholders the greatest degree of protection, after the year 2000 countries in Western Europe, East Asia, and, especially, Eastern Europe and Central Asia had passed new legislation protecting minority shareholders.

The authors show that many countries around the world passed such new rules and regulations in response to a number of factors, including new economic ideas about free markets, imitation of other countries in the same region, emulation of the United States as the global financial leader, and pressures from the International Monetary Fund, which grew eager to induce countries in under financial stress to implement reforms.

By the 2010s, the countries in the world with the greatest degree of protection of minority shareholders were Kazakhstan, Russia, Uzbekistan, South Korea, Mauritius, and Poland. This phenomenon begs the question of whether legal reforms protecting minority shareholders are actually enforced or if they remain largely ceremonial. The research by Guillén and Capron, which carefully takes into account a number of economic and financial variables, conclusively shows that the adoption of legal protections has increased stock market capitalization, trading, and turnover. But they also found that the beneficial effects of such legal provisions are larger when the government has the capacity to enforce them.

Guillén and Capron argue that governments should continue to promote minority shareholder rights as an antidote against the abusive use of private information. Global competition for capital has intensified considerably, and having an appropriate legal framework that protects minority shareholders should be at the top of the policymaking agenda. Their research also has implications for companies and investors. Companies making investments in foreign countries need to carefully consider the extent to which minority shareholder rights are protected whenever they make decisions about floating part of their equity in a foreign subsidiary. Investors seeking global diversification of their portfolios also need to study the international map of shareholder protections before making decisions.

In Malaysia the legal protections are in place, and the government has the capacity to enforce them, but will they do that, without fear or favour? Or are the reforms in the name of good (corporate) governance mostly ceremonial?

63 Innovation agencies ...

From The Malaysian Reserve:

The government plans to address the existence of too many government agencies involved in innovation and technology in order to enhance efficiency and eliminate red tapes, said Datuk Seri Mohd Najib Razak.

The prime minister (PM) said presently there are a myriad of entities with so many roles which have created the risk of fragmentation in the innovation space.

“At the last count, entities in the government involved in technology innovation include:

The government plans to address the existence of too many government agencies involved in innovation and technology in order to enhance efficiency and eliminate red tapes, said Datuk Seri Mohd Najib Razak.

The prime minister (PM) said presently there are a myriad of entities with so many roles which have created the risk of fragmentation in the innovation space.

“At the last count, entities in the government involved in technology innovation include:

- five units under PM’s Department

- three ministries with direct technology funding

- six ministries with technology associations

- three regulators

- four councils that I chair

- four other councils

- three development corporations with funding

- seven development agencies or corporations

- one foundation

- six research institutions

- five mutual funds

- five managed funds

- 11 funding agencies

If I add them all up, 63 in total. Simply amazing .....

Monday, 5 October 2015

XingQuan: does the company believe its own cash? (2)

Bursa has queried XingQuan about its rights issue, and the company has replied:

The Company wishes to clarify that the cash balance of RM886.55 million is mainly reserved for working capital, and as explained in the announcement dated 25 September 2015, Xinquan requires sufficient cash buffer and a high level of working capital to ensure minimal disruption to its operations in the event of a liquidity crisis or a sharp economic downturn. The purpose of the Proposed Rights Issue with Warrants is to raise funds for Xinquan’s capital expenditure requirements whilst maintaining a healthy level of cash balances at all times.

In addition, the available cash balance may also be used for future business expansion into related businesses, in particular, acquisition of foreign brand(s), if and when the opportunity arises.

The Group has placed its cash balances in savings accounts with licensed banks in China which carries an interest rate of approximately 0.35% per annum. The cash is placed in savings accounts as the cash is not idle and is required to fund Xinquan’s day-to-day operations.

I find the answers completely unsatisfactory given the size of its current operations. Just looking at balance sheet items like inventory, receivables, payables etc. gives an indication roughly how much cash the company needs in case the company grows, or in case there is a calamity. The company has abundant cash for all those purposes, much more than needed.

Regarding business expansion, first of all that sounds very vague, secondly those take time, the company could still raise money when the opportunity arises.

The company claims that it can not put money (not even a few hundred million RM) in a fixed deposit since it needs the money in day-to-day operations. That sounds highly questionable. The company should be forced to proof that, by showing the minimum amount of cash throughout the year in all saving accounts.

Chinese listed companies have a really bad reputation for its cash management. There have been fraud cases where the promised money was simply not there. Others have embarked on acquisitions (sometimes in related party transactions) that have destroyed value. They hardly pay out a decent dividend or embark on a share buyback program. In the contrary, they rather use private placements at share valuation below the amount of cash per share.

It doesn't make sense at all, and if that is the case, then in my experience most likely something else is going on, something more sinister.

There is still my suggestion in the previous posting.

More than four years ago I warned already about Chinese listed companies with cash levels that can not be trusted. Free advice for Bursa, it can't get much better than that, can it?

The Company wishes to clarify that the cash balance of RM886.55 million is mainly reserved for working capital, and as explained in the announcement dated 25 September 2015, Xinquan requires sufficient cash buffer and a high level of working capital to ensure minimal disruption to its operations in the event of a liquidity crisis or a sharp economic downturn. The purpose of the Proposed Rights Issue with Warrants is to raise funds for Xinquan’s capital expenditure requirements whilst maintaining a healthy level of cash balances at all times.

In addition, the available cash balance may also be used for future business expansion into related businesses, in particular, acquisition of foreign brand(s), if and when the opportunity arises.

The Group has placed its cash balances in savings accounts with licensed banks in China which carries an interest rate of approximately 0.35% per annum. The cash is placed in savings accounts as the cash is not idle and is required to fund Xinquan’s day-to-day operations.

I find the answers completely unsatisfactory given the size of its current operations. Just looking at balance sheet items like inventory, receivables, payables etc. gives an indication roughly how much cash the company needs in case the company grows, or in case there is a calamity. The company has abundant cash for all those purposes, much more than needed.

Regarding business expansion, first of all that sounds very vague, secondly those take time, the company could still raise money when the opportunity arises.

The company claims that it can not put money (not even a few hundred million RM) in a fixed deposit since it needs the money in day-to-day operations. That sounds highly questionable. The company should be forced to proof that, by showing the minimum amount of cash throughout the year in all saving accounts.

Chinese listed companies have a really bad reputation for its cash management. There have been fraud cases where the promised money was simply not there. Others have embarked on acquisitions (sometimes in related party transactions) that have destroyed value. They hardly pay out a decent dividend or embark on a share buyback program. In the contrary, they rather use private placements at share valuation below the amount of cash per share.

It doesn't make sense at all, and if that is the case, then in my experience most likely something else is going on, something more sinister.

There is still my suggestion in the previous posting.

More than four years ago I warned already about Chinese listed companies with cash levels that can not be trusted. Free advice for Bursa, it can't get much better than that, can it?

Sunday, 4 October 2015

Tony's Top Ten Tips

I have often been critical about AirAsia (and even more so regarding AirAsia X) in this blog, especially regarding the aggressive accounting and the convoluted corporate structure.

But I did like the entrepreneurial spirit and "can do" attitude of Tony Fernandez and his staff.

Tony was invited to speak at an event organised by Digital News Asia and didn't disappoint with his speech "What’s Next: Tony’s Top 10 Tips for Entrepreneurs".

I think they are great tips, so I will copy them here from the above link:

1) You don’t need to know everything

I came from the music business. I knew nothing about planes. To all the entrepreneurs out there, you don’t need to know everything about what you want to do. It’s all about the idea, it’s about passion, it’s about implementing it.

2) Just do it!

Don’t let anyone tell you that you can’t do it. You’ve got one life, so you can’t press the rewind button and say ‘I wished I had done that.’

So I recommend to all of you out there, just do it. Live your life to the utmost, be positive. If you fail, at least you have tried.

I have failed miserably at Formula One, but I have no regrets because I got to stand with the greats from Ferrari, McLaren, and others.

3) Passion is a key problem-solver

Dreams do come true. Don’t worry about failure. You have one life, make the most out of it. Nine times out of 10, if you have the passion, you will find a way to work through it.

4) Invest in marketing

If you have the greatest idea in the world, please, please, please put some money on marketing. This is because if you don’t put money on marketing, nobody is going to hear about your great idea.

There are so many great ideas that never took off because of a lack of marketing.

Marketing is not about the dollars, it is also about public relations (PR). In AirAsia, we had no money. So I ran around with a red cap on and said controversial things so that the press would always take a picture of me. That was our marketing in AirAsia’s early days.

We have been through so many issues, and marketing played a key role in overcoming them.

Remember SARS (severe acute respiratory syndrome)? At that time, nobody wanted to fly; we all thought we are going to die.

Everyone cut their advertising, but I told my guys not to cut because this was the best time to build our brand. In fact, we tripled our advertising and everyone looked at me and said, “Are you on drugs?” I said, no, it is the best time because no one else is advertising.

When the first Bali bomb attack happened, everyone cancelled their flights. I said to the guys, we cannot let the Bali route die. We must continue to fly.

So we came up with ‘Love Bali’ campaign, giving away 10,000 free seats, and it worked. All 10,000 seats were snapped up in like under one minute. And all those who got those seats told all their friends about it on social media. Your best advertisement is your customers.

5) Leverage social media

When Malaysians get a good deal, they will tell the whole world about it. So the 10,000 people who went and had a good time in Bali, told 10,000 people that they had a good time. That was the early gestation of AirAsia’s social media.

We realised the power of social media very early on, so when Facebook and Twitter came up, we latched onto them. We were early adopters. We now have 32 million people on our various social media platforms, and 7% of our business comes directly from social media.

The Bali campaign taught us that our best advertisements are our customers.

6) Don’t be scared of complaints

Complaints are actually free market research. Someone took the effort to write to you to tell you where things went wrong and how they should be improved. These are things that companies pay a lot of money for consultants to tell them that same thing.

So we treat every email preciously.

7) Focus on one image when it comes to branding

During the early days, there was the word ‘AirAsia’ and a logo of a bird in our branding.

If you look at the top brands in the world, there’s only one image that comes to your mind. When I say “Shell,” you think of the Shell logo. When I say “Coca-Cola,” you think of the word ‘Coke’ in italics, and when I say “Nike,” you think of the swoosh.