Why did it take the Securities Commission so unbelievable long to issue this? It looked crystal clear from the start of the investigation (July 2010) that something was very, very wrong here.

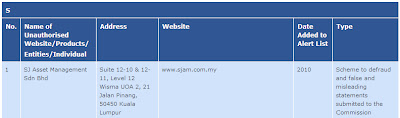

Interestingly, the Securities Commission had already warned before about SJAM on its own website, in words that could not be more clear "a scheme to defraud":

Both this list of unauthorised websites/investment products/companies and individuals and the referral list by IOSCO are, by the way, highly recommended, great service in a country where so many cheating schemes (especcially pyramid schemes) seem to thrive. With very limited and slow enforcement, people should stay alert themselves. I hope the lists will be updated regularly.

Some more information about the rather mysterious ties between SJAM and Maxbiz can be found here and here.

Interesting quote from Tan Whai Oon: "For a listed company, we don't normally ask for board representation. there is supposed to be much more transparency in listed companies, there is supposed to be corporate governance and independent board members".

This sounds all rather naive, to hear this from a fund manager in the Malaysian context, may be that is why he is rumored to have gone to Nepal?

Some high net worth customers of CIMB were referred to SJAM, as this article from PWM (Professional Wealth Management) shows: CIMB striving to stand out from the Malaysian crowd. CIMB will definetely stand out from the crowd through this recommendation, but not for the good reasons, their "holistic approach to wealth management" didn't seem to work, at least in this case:

Many, many questions remain in this case:

- How much of their money will clients from SJAM receive back?

- How long was this scheme going on (from The Star: "Subsequently, a senior finance executive of the company spilled the beans on the accounts that have apparently been cooked since 2001")?

- Which company was responsible for auditing the accounts of SJAM?

- Where were the regulators all those years?

- When will finally some justice be done?

- When will all the issues surrounding Maxbiz and Geahin be clarified?

- Etc, etc, etc.

Hi any comment on MAS? The "crown jewel" of Bursa Malaysia. My dad and I predict there will be a cash call for MAS within 3rd quarter of this year.

ReplyDeleteYes, will write about MAS and Silver Bird, have been too busy lately. If cash call, do you think TonyF's holding company will take up his part? He just invested in MAS.

ReplyDeleteWhy so coincident all the companiesnlike perwaja, MAS, proton are running to hit bump???

ReplyDeleteI am pretty sure the enforcement red tape could be further reduced, 2 years for arrest warrant... I MEAN what is the chances of recovery...

Chances for recovery: I have no idea, at the moment transparency in this case has been almost zero. I am scared the authorities have been sleeping on the job (surely fund managers must be monitored on a regular basis), explaining why they are so hesitant to reveal any information at all. Also, they are so sensitive about their image, not realzing that fast and decisive action would be good for the image, not this dragging on of cases from the past.

ReplyDeleteErm I think Tony won't let his shares diluted. He need to maintain his portions in order for him to maximize the profit of AA.

ReplyDeleteHow come CIMB did not sack the people that were involved in the SJAMBOK fiasco?

ReplyDeleteAsk CIMB. My guess is that they don't want to draw any more attention to this whole affair. One really has to question CIMB if they have done proper due diligence on SJAM in the past.

ReplyDelete