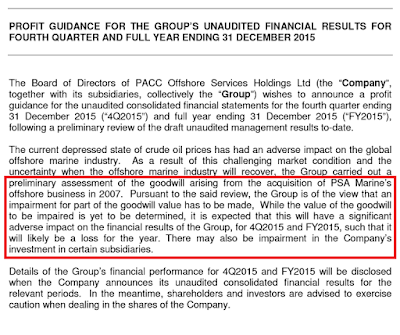

I have warned many times in this blog about the upcoming loss (for instance in 2014), in regards to the need to impair the valuation of its associate company, POSH (PACC Offshore Service Holdings).

A loss of almost RM 1.2 Billion due to many provisions, impairments, etc., surely Maybulk must have taken the big bath?

But surprisingly, this has not been the case at all. When we dive into the accompanying notes to the accounts, we find the following:

In other words, the valuation used is almost three times as high as the market value, a staggering RM 652 Million difference.

On a side note, one wonders, if the POSH shares are really so much more valuable than the market price suggests, why does Maybulk still purchase new vessels, why not buy additional POSH shares? It can immediately mark up the price in its books by a factor 2.85, for every RM 100 Million invested it can book a cool profit of RM 185 Million!

If however the full impairment was taken into account (I think a lot more realistic), then the loss for 2015 would have been more than RM 1.8 Billion.

The reasons for the relatively low impairment that was used can be found in the following paragraph:

I don't like DCF projections, have warned about its use many times in this blog. Basically, by tuning some parameters financial engineers can come up with about any valuation that they want. And that is often how DCF is used (or rather misused), especially in the Malaysian context.

Some considerations in this particular case:

- The calculation itself is never given (as usual), so we can' t check its reasonableness. This is especially important in this case since DCF was used twice to calculate POSH's value (at the initial RPT and at the IPO), and both times the resulting valuation was hugely optimistic.

- The DCF valuation depends so much on the underlying assumptions, as shown above, one percent change in the discount rate will change the valuation RM 230 Million, a huge impact.

- The only cash that Maybulk gets from its investment in POSH is dividends, and they have been tiny over the last eight years, most of the years they did not receive a single cent, so how is it possible to come up with such a high valuation?

- And lastly, why did Maybulk change its method of valuation, from the unexplained price-to-book ratio in the previous year to DCF, why is no explanation given?

The balance sheet took a hit because of the reported loss, but with a debt equity of 52%, things still look reasonable (left column 2015, right column 2011):

However, if we adjust the numbers for the market value of the POSH shares, then the balance sheet looks like this:

Suddenly the borrowings are larger then the shareholders equity, implying a debt/equity ratio of clearly more than 1.

The financial picture does not look solid:

- Cash of only RM 140 Million

- Borrowings of RM 608 Million (of which RM 225 Million short term)

- Capital commitments of RM 410 Million

- Over 2015 the company booked an operating loss of RM 100 Million

- Its RM 1.1 Billion investment in POSH is hardly paying any dividend

And then taking into account that just 2.5 years ago Maybulk could have sold back its investment in POSH by exercising its put option for a profit of a few hundred million (not the current paper loss of RM 756 Million), generating more than 1 Billion extra cash, and without the need to invest a few hundred million for POSH's IPO shares.

In other words, instead of being a highly leveraged company in a weak financial position, Maybulk would be sitting comfortably on top of a huge cash pile. It could have given out RM 1 dividend per share (more than the current share price!) and would still have more cash and less borrowings than now.